July 30, 2020

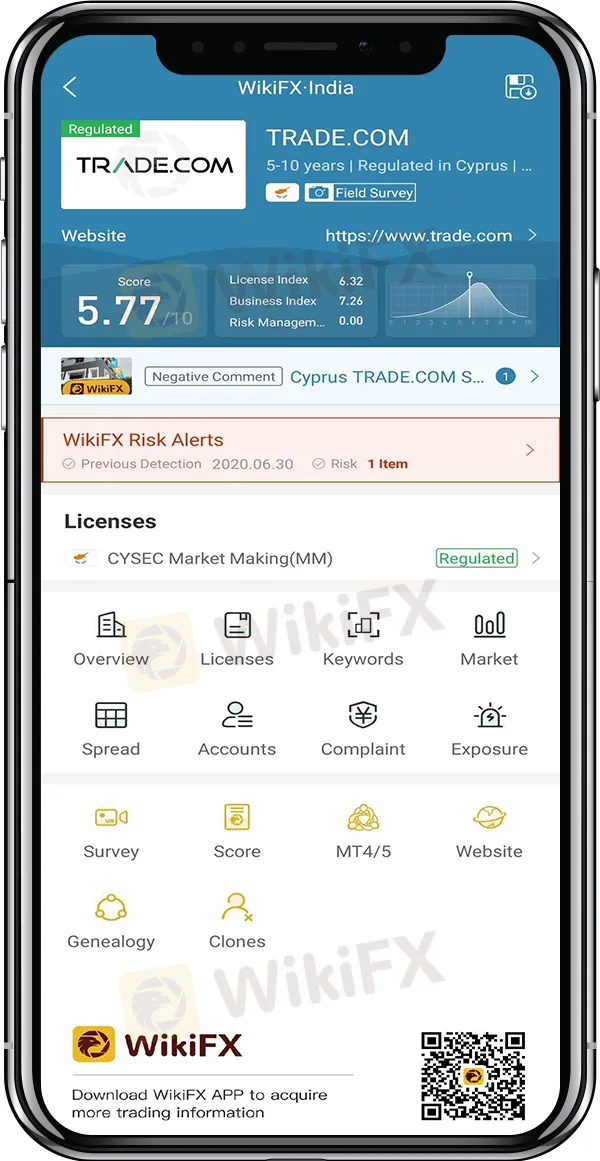

After the field investigation on TRADE.COM, WikiFX rated it as poor and warns investors against facile deposit.

One of the complainants told WikiFX that he was mildly interested in TRADE.COM at first. To begin with, he set up a virtual account on its platform for observation and more information. "I never expected the platform to be so disordered that it can screw up a virtual account.â€

The above two pictures show the price trends of sweet crude oil on TRADE.COM and an authoritative platform respectively, which were both shared by the complainant. By comparison, he observed that even for the same crude oil futures, the data in the two platforms actually differs by at least 0.3 points.

The complainant said that: "The difference is large. Apparently, TRADE.COM is fixing the prices and thereby deceiving investors.†Fortunately, his account is just a virtual one, otherwise the losses may be considerable.

TRADE.COM is currently under CySEC's normal supervision. Nevertheless, WikiFX alerts investors to the risks of this broker considering the increasing complaints recently. WikiFX also reminds investors to check the authenticity of a broker‘s license, regulatory information and market data before choosing the broker. Click WikiFX APP to check broker’s qualification now.

So far, WikiFX App has included profiles of more than 19,000 forex brokers around the world, while integrating broker information query, exposure, news feed and other functions, and protecting investors fund safety in forex trading. More exposures are coming soon.

Posted by: shinenewstop at

05:21 PM

| No Comments

| Add Comment

Post contains 320 words, total size 3 kb.

Awaited figures on Tuesday are Japan‘s (CPI) and core CPI for June, and Canada’s retail sales and core retail sales for May.To get more news about Expert 24 Trade, you can visit wikifx news official website.

On Wednesday, the American Petroleum Institute (API) will report weekly inventory levels of crude oil and gasoline changed as of July 17. Other data out on the same day are Canada‘s CPI and core CPI for June, and Federal Housing Finance Agency’s (FHFA) house price index for May. On Thursday, Germany is going to publish its Gfk consumer confidence indicator (CCI) for August while the U.S. will release initial jobless claims and continuing claims for the week ended July 18. In the mean time, CCI for July in the euro area will be confirmed.

Gfk CCI for July in the U.K. will be focused on Friday, together with the initial value of Markit manufacturing PMI for July in France, Germany, Britain, the euro area and the United States. On the same day, the Economic and Financial Affairs Council (ECOFIN) of EU will be eyed for the budget and stimulus package discussed.

Posted by: shinenewstop at

05:12 PM

| No Comments

| Add Comment

Post contains 230 words, total size 2 kb.

"This plainly has been a recovery and a pretty sharp one,†he told lawmakers on Parliaments Treasury Committee. "As has been the case of course globally -- in that sense we have seen a bounce-back, so far it has been a V. That does of course not tell us where we might go next.â€

Haldane dissented at the BOE‘s June meeting, voting against expanding asset purchases. He’s since come across as more upbeat about the economy than Governor Andrew Bailey and fellow policy maker Silvana Tenreyro, who will also address lawmakers this afternoon.

Haldane said the economy likely hit its floor in April, and about half of the roughly 25% fall in activity in March and April has been regained. But he noted that labor market figures are "understating the unemployment problem†and policy makers are monitoring the job situation carefully.

Were "by no means out of the woods on activity or jobs, but materially better than expected two or three months ago,†he said.

BOE officials will publish updated forecasts at their next policy meeting on Aug. 6. They have been reviewing tools at their disposal, including negative interest rates, after cutting rates to a record low 0.1% and expanding their bond-buying program.

"There is plainly less room for monetary maneuver as a result of this crisis, be that interest rates or further QE,†Haldane said. "But less room for maneuver is not no monetary maneuver at all.â€

Negative interest rates could potentially encourage further borrowing, though they would also have downsides like a squeeze on banks margins, he said.

Posted by: shinenewstop at

05:04 PM

| No Comments

| Add Comment

Post contains 315 words, total size 2 kb.

Sales dropped by almost 40% to 6.62 billion euros ($7.6 billion), the German auto-parts maker said in a statement Monday. Analysts on average were expecting revenue to drop to 6.37 billion euros, according to data compiled by Bloomberg.

Although business "showed substantial improvement through the course of the second quarter,†Continental said in the statement, there is still "substantial uncertainty due to the ongoing Covid-19 pandemic.â€

"It remains difficult to gauge possible adverse consequences on production, the supply chain and demand,†the company said.

Continental and its peers rushed to drastically cut costs earlier in the year when shutdowns aimed at containing the spread of the virus hit auto factories and showrooms, bringing production to a halt and significantly curbing sales. The company announced in June that it would cut its dividend payout to save about 350 million euros.

The uncertainty over how fast economies will recover is still an open question. Automotive companies are hoping government incentives will spur car sales and help the industry recover in the second half of the year.

Posted by: shinenewstop at

04:56 PM

| No Comments

| Add Comment

Post contains 225 words, total size 2 kb.

Researchers found it triggered an immune respond to Covid-19 with only minor side effects. AstraZeneca subsequently spiked over 10 percent before retreating and closing just a little over 6.50 percent from the open.

Foreign exchange markets were somewhat mixed. The haven-linked US Dollar and anti-risk Japanese Yen and Swiss Franc along with the Euro suffered the deepest burns. Higher-beta FX like the Norwegian Krone and Swedish Krona on the other hand were sunbathing on green pasture with the British Pound. Sterling rose not so much due to GBP strength per say but rather due to weakness in its counterparts.

The Euro was left out in the cold after European Union policymakers failed to reach a consensus on what is shaping up to be the longest meeting since the 2000 summit in Nice, France. The so-called "Frugal Four†– led by Dutch Prime Minister Mark Rutte of the Netherlands and followed by Sweden, Denmark Austria and Finland – have pushed to modify the EUR750 billion aid package.

The new proposal that may be generous enough for big-spending advocates to get behind and watered-down enough for the Frugal Four to swallow reduced the amount of grants to 390 billion and increased the loan amount to 360b. The original was 500b and 250b, respectively. Until a solid agreement is reached, the Euro will likely continue to hover with a cautious upside bias. Read more about why that is here.

Tuesdays Asia-Pacific Trading Session

In addition to the politically-entangled Euro, the Australian Dollar will likely also be in the spotlight. The Reserve Bank of Australia will be releasing their meeting minutes following the interest rate decision on July 7. Officials noted that while the path ahead is uncertain, "conditions have, however, stabilised recently and the downturn has been less severe than earlier expectedâ€.

Policymakers reinforced this notion, saying that the worst of the economic crisis may be behind as leading indicators point to signs of stabilization. Officials reiterated they are"prepared to scale-up its bond purchases†in order to achieve their employment and inflation targets. Unless the RBA significantly deviates from this message – be it more positive or negative – AUD may shrug at the comments.

Australian Dollar Analysis

After bottoming out in March, AUD/CAD has gone on to rise over 14 percent in a relatively short span of time. However, technical cues are hinting that upside momentum may be slowing with RSI showing a negative divergence. Capitulation could shatter a multi-week uptrend and open the door to retesting stubborn support at 0.9293. Follow me on Twitter @ZabelinDimitri for more timely technical updates.

Posted by: shinenewstop at

04:45 PM

| No Comments

| Add Comment

Post contains 505 words, total size 4 kb.

The ticket worth a million bucks was sold for Saturday’s $117-million Powerball jackpot at the Fast Mart near 27th and Wildcat Drive. Nebraska Lottery officials say the ticket had the first five numbers in the drawing, but not the Powerball itself.

The winning numbers from Saturday’s Powerball® draw were 05, 21, 36, 61, 62, Powerball 18, and Power Play 02. Players are encouraged to check their tickets at any Nebraska Lottery retailer, online, or by calling the Lottery office at 402-471-6100.

Winning Nebraska Lottery Lotto tickets expire 180 days after the drawing. Prizes of $20,000 or more must be claimed in person at Lottery headquarters in Lincoln. Additional information about claiming prizes can be found at the Nebraska Lottery website, or by calling 800-587-5200.

Posted by: shinenewstop at

04:23 PM

| No Comments

| Add Comment

Post contains 159 words, total size 1 kb.

The New Jersey Lottery announced on Saturday morning that the only Mega Millions jackpot winning ticket from Friday night's drawing was sold at the Bayonne convenience store.

"l’m happy to congratulate Brenda’s Inc. on 110 Kennedy Blvd in Bayonne, the retailer that sold this winning ticket,†said Executive Director James A Carey, Jr. The winning numbers for the Friday, July 24 drawing are: 08, 33, 39, 54, and 58. The Gold Mega Ball is 17 and the Megaplier is 03. The jackpot winner will receive an estimated prize of $124,000,000 annuity ($100,800,000 cash)

The winner should sign the back of the ticket, make a copy of both sides and put it in a safe place, and contact Lottery Headquarters at 609-599-5875 to arrange to file a claim for this ‘MEGA’ jackpot prize.The winner has one year from the date of the drawing to file a claim.

A press event is being planned for Monday to present the lucky retailer with their celebratory bonus commission check worth $30,000.

Posted by: shinenewstop at

04:11 PM

| No Comments

| Add Comment

Post contains 194 words, total size 1 kb.

It’s so good that in its first year of existence (2019), it won two KBB Best Buy Awards. The 2021 model year now includes Volvo’s first completely electric vehicle (EV), the XC40 Recharge P8 AWD.

The 5-seater XC40 has the right combination of looks, size, and features at a price within the reach of young, affluent buyers. Its broad range of models, generous standard equipment, long list of sophisticated options, and punchy 2.0-liter turbocharged engine make the 2021 XC40 a superb choice.

How Much Does the 2021 Volvo XC40 Cost?

The Manufacturer’s Suggested Retail Price (MSRP) of a 2021 Volvo XC40 T4 Momentum is $33,700, plus a $995 destination fee, bringing the total to $34,695. The T4 R-Design is priced from $39,945, and the T4 Inscription is $40,445 before options.

The T5 Momentum starts at $36,695. T5 R-Design pushes the price to $41,945, and the range-topping T5 Inscription comes in at $42,445.

Loading up a T5 Inscription with most of the optional tech and the Harman Kardon sound system comes to around $45,500, which is on the bearable side of crazy. The starting and midpoints of the XC40 also compare well with its rivals. For example, the Lincoln MKC is priced similarly, but without all the safety features and amenities that come standard on the XC40.

There were no prices for the 2021 XC40 Recharge P8 AWD at the time of compiling this review. However, we anticipate it starting around $48,000 after federal and tax credits.

Before buying, check the KBB.com Fair Purchase Price to see what others in your area are paying for their new XC40. We don’t have any definitive data on resale values just yet, but we expect the XC40 to perform well in this respect.The turbocharged 4-cylinder engine of the T5 is even livelier than its 248 horsepower suggests. It’s a little dynamo, with minimal turbo lag. This subcompact luxury SUV will zip from standstill to 60 mph in 6.2 seconds and has plenty of muscle in reserve for higher-speed passing. In the front-drive T4 models, horsepower drops to an adequate 187.

The XC40 is exceptionally nimble and easy to maneuver, whether in a parking lot or on the freeway. Despite its short length and modest wheelbase, the XC40 is comfortable and adept at absorbing road imperfections. It’s also fun to push on a winding road, especially the R-Design models, with their sportier suspension and larger wheels.

Drivers will be grateful for the XC40 T5’s standard all-wheel drive and 8.3 inches of ground clearance whenever the weather turns rough. Grip is commendable when snaking around dry roads and confidence-inspiring in general. The elevated seating position is also excellent.

Posted by: shinenewstop at

03:59 PM

| No Comments

| Add Comment

Post contains 506 words, total size 3 kb.

Lenovo's ThinkPad series is known for its refined black aesthetic, strong productivity, impressive build quality and the show-stealing star, the Thinkpad X1 Carbon. Many ThinkPad devices aren't pocket-friendly, which is why our ears perked up at the mention of an upcoming affordable laptop lineup.The leaked roadmap unearthed Lenovo's plans to release "affordable" workstation models within the ThinkPad family, including a model called ThinkPad P15v. The "v" in the name signifies that this configuration will be a value version of the higher-priced ThinkPad P15 model. Both models are slated to hit shelves later this year with Comet Lake H-series CPU chips.

NotebookCheck added that Lenovo may also release a refreshed ThinkPad P15v under the T-series umbrella called the ThinkPad T15p. The models will be quite similar, but both will sport different GPUs.

The ThinkPad P15, by the way, will be the successor to the chunky, heavy-duty workstation known as the ThinkPad P53, which hints that Lenovo has adopted a new naming convention. The upcoming Lenovo ThinkPad P17 will succeed the ThinkPad P73 -- another example of Lenovo's naming shift.Lenovo, according to the roadmap, is expecting the 10nm Intel Tiger Lake chips and the lower-powered Lakefield CPUs to launch in September or October. The Chinese tech giant plans to release several models with the highly anticipated hardware, including the X1 Fold.

We're quite familiar with the X1 Fold -- we got our hands on the Lenovo product at CES this year. Touted as the world's first foldable PC, the Windows 10 device is expected to set you back a whopping $2,500. The X1 Fold, according to Liliputing, will sport an Intel Lakefield five-core processor.

As for Intel Tiger Lake, NotebookCheck suspects the chip will debut in at least three upcoming models: The Lenovo ThinkPad X1 Titanium, the ThinkPad X1 Nano and the ThinkPad X12.

The ThinkPad X12, featuring a 12-inch display, is particularly eye-catching because it's a detachable device reminiscent of the Microsoft Surface-style design.With Lenovo poised to release at least 16 new laptops this year, there seems to be an option for everyone -- from the stunning, break-the-bank X1 Fold with its foldable OLED display to the budget-friendly ThinkPad P15v.

Intel Tiger Lake chips will debut on Lenovo's most premium models, and we're excited to see how the follow-up to the 10th-gen Ice Lake processor family performs on our real-world testing.It's also worth noting that Intel isn't the only processor that Lenovo will stuff into its products this year -- AMD will get some shine as well, especially for a few models in Lenovo's T and L series device line-up.

We can't help but wonder if any of the upcoming additions to Lenovo's portfolio will make the same waves as its X1 Carbon superstar.

Posted by: shinenewstop at

03:52 PM

| No Comments

| Add Comment

Post contains 505 words, total size 3 kb.

"We recognise that there are hundreds of thousands of transactions happening across our auction houses on a regular basis, and we want to create a modern system that is smooth and easy to use.â€

It appears that with the new Auction House players will be able to purchase partial stacks of goodies from others rather than having to take everything in one go. A post on the Blizzard forums from community manager Kaivax expands on this: "Commodities (stackable items) cannot be bid on, and are no longer bought or sold in stacks. Now, you’ll enter in the number of a commodity that you’d like to buy and the AH will automatically select the cheapest available and give you a total price.â€Plus, there are other exciting features for players to try out that should enhance and smooth the whole WoW trading experience, like a ‘shopping list’ for your favourite items. You can make a checklist of your go-to items, and more "quickly search for and buy [them] on the go.â€

Blizzard’s put the all-new Auction House on the PTR for players to try and give feedback on. If you’re a World of Warcraft Classic player, you can check out our WoW Classic Auction House guide for new players, which you might find handy.

Posted by: shinenewstop at

03:42 PM

| No Comments

| Add Comment

Post contains 319 words, total size 2 kb.

Posted by: shinenewstop at

03:31 PM

| No Comments

| Add Comment

Post contains 610 words, total size 4 kb.

Outside of the game’s launch, this update will bring more items, quests, and changes to Classic than any other phase before it.To get more news about Buy WoW Gold Classic, you can visit lootwowgold news official website.

Along with a massive "war effort†that will require members of both the Alliance and Horde to gather resources for a fight against the Qiraj Empire, players will gain access to new bosses and loot from dungeons that they’ve been running for almost a year now.

Meanwhile, updates to other elements of the game, like professions and reputation rewards, will give players a laundry list of things to do after the game’s weekly Tuesday reset.Trying to do everything at once might be overwhelming. But if you go into the week knowing exactly what your character wants and needs to do, the chances that you achieve your goals will improve exponentially.

Here’s a list of some of the things you might want to look into before logging in this afternoon.The opening of the Gates of Ahn’Qiraj (AQ) is one of the most iconic events in WoW’s original expansion. But that won’t happen right away. First, players from both factions will have to donate an enormous amount of resources to a war effort against the Qiraj Empire.

NPCs for both sides will accept donations of specific items to prepare for the AQ gate opening event. The gates themselves won’t open on a server until all of the necessary resources are gathered.

While many servers have been preparing for months to have the resources needed to open up the gates as fast as possible, it might be worth contributing as an individual to do your part. As a way to reward players for contributing, NPCs reward donations with a small war supply item and "commendations†that can be used to earn certain Horde and Alliance reputations. In addition to each server needing to work to get all of the required resources for the AQ gates to open, there’s a specific questline as well that needs to be completed by any individual on the server.

Rewarding the Black Qiraji Battle Tank mount, known as the "bug mount,†to the first on a given server to complete it, this series of quests is one of the most grindy in the game. And because of the way it requires players to go into two separate instances of the Blackwing Lair raid, it’ll be impossible to complete until BWL resets on Aug. 4.

If you’re just now hearing about this questline, you probably won’t be able to get it done prior to the gates opening. But don’t let that stop you. Despite the chain’s length, it has fruitful rewards outside of the bug mount that will only go to the first people to complete the quest during the AQ gate opening event

Posted by: shinenewstop at

03:16 PM

| No Comments

| Add Comment

Post contains 483 words, total size 3 kb.

July 22, 2020

Giving the green light to negative rate doesnt mean the central bank will immediately adopt a rate below zero. What the central bank is doing right now is planning for the next step after a potential shock in the future, and the pandemic accelerated the process. Currently the central bank is relying on QE as the main stimulus approach, the government has a rising demand for borrowing, and a risk of further shrinking economy also confirms the need for easing policies.

With the government launching unprecedented measures to prevent possible economic breakdown due to the pandemic, Britain‘s budget deficit in April climbed to an unprecedented high since the modern record was established in 1993, with central government spending surging 57% and income falling 27%. Even during the financial crisis, Britain’s monthly borrowing had never exceeded 22 billion pounds.

Posted by: shinenewstop at

09:53 AM

| No Comments

| Add Comment

Post contains 210 words, total size 2 kb.

In other words, they make money by selling the currency to you for more than they paid to buy it. And they also make money by buying the currency from you for less than they will receive when they sell it. This difference is called the spread.

For example: If you want to sell your old phone to a second-hand store, in order to make a profit, the shop owner needs to buy your iPhone at a price lower than the price he‘ll sell it for. If the phone can be sold for 300 dollars, the owner can buy it from you for 299 dollars at most in order to make money. That difference of 1 dollar is the spread. Therefore, if you meet a broker that claims "zero commissions†or "no commissionâ€, it means there is no separate commission fee to pay but you still need to pay a commission. It’s just built into the bid/ask spread!

How is the Spread in Forex Trading Measured?

Pips are used to measure the spread, and a pip is the smallest unit of the price movement of a currency pair. One pip is equal to 0.0001. An example is that if you buy a currency pair EUR/USD which is 1.1038/1.1040, you need to paid 2 pips of spread. You need to pay 20 dollars to the broker. It is worth noting that Japanese yen's spread is only quoted to 2 decimal places, for example, if price of the currency pair USD/JPY is at 100.00/100.04, the spread is 4 pips.

WikiFX App is a third-party inquiry platform for company profiles.WikiFX has collected 17001 forex brokers and 30 regulators and recovered over 300,000,000.00 USD of the victims.

It, possessed by Wiki Co., LIMITED that was established in Hong Kong Special Administrative Region of China, mainly provides basic information inquiry, regulatory license inquiry, credit evaluation for the listed brokers, platform identification and other services. At the same time, Wiki has set up affiliated branches or offices in Hong Kong, Australia, Indonesia, Vietnam, Thailand and Cyprus and has promoted WikiFX to global users in more than 14 different languages, offering them an opportunity to fully appreciate and enjoy the convenience Chinese Internet technology brings. WikiFXs social media account as below:

Posted by: shinenewstop at

09:44 AM

| No Comments

| Add Comment

Post contains 469 words, total size 3 kb.

Swedish Finance Minister Magdalena Andersson said on Tuesday that her country supports a united response by the EU, but would not back the proposal from Berlin and Paris that would see the bloc tap the bond market for an unprecedented amount of money and distribute that as grants to countries that have suffered economically from the global pandemic.

Read More: Rival Plans for EU Crisis Fund Signal Bumps in the Road to Come

"We also will support some kind of recovery fund but we will have to discuss exactly how it will look like and from our perspective we think it has to be realistic both when it comes to size but also the conditions,†Andersson said in an interview with Bloomberg TV.

Andersson‘s comments come just a day before the European Commission, the EU’s executive arm, unveils its proposal for a recovery package. Her remarks highlight the difficult negotiations the EU‘s 27 governments will have over the coming weeks. Some of Sweden’s fiscally conservative allies in recent days have already shown an openness to compromise that may lay the groundwork for an eventual accord.

Loans vs Grants

The commission‘s proposal will form the basis for discussions between EU governments, though dividing lines have already been drawn. France and Germany want the fund to make grants to countries and sectors most in need, while also saying that their plan wouldn’t lead to the mutualization of debt. Austria, Denmark, the Netherlands and Sweden released their won blueprint over the weekend that would offer loans to countries rather than grants, and would expire after two years.

While EU leaders have agreed on the need for a fund to assist with the recovery, disagreements include its size, whether allocated money would need to be repaid and any conditions tied to the disbursements. While theyve broadly accepted that some of the money will come from jointly-issued EU debt, how much the bloc will raise remains in dispute.

France and Germany threw their weight behind a plan to allow the commission to issue 500 billion euros of bonds, a significant shift for German Chancellor Angela Merkel who has previously resisted French calls to shoulder more of the burden of the European recovery. The proposal would require approval by all 27 EU countries and the European Parliament.

And despite their skepticism, at least some of the four countries most averse to the Franco-German plan have already softened their positions, signaling a compromise may be in the offing.

Austrian Finance Minister Gernot Bluemel said in an interview with Austrian public TV that an agreement could see some of the aid disbursed as grants. Asked if a deal was thinkable in which the majority of the aid would be disbursed as grants, Bluemel told broadcaster ORF: "What we dont want is that it will be only grants, and that this is the start of debt mutualization.â€

Still, giving hard-hit countries loans rather than handouts would be more palatable, according to Andersson. It would be "easier to explain to the citizens of Europe if we work with loans rather than grants when it comes to the recovery phase.â€

Posted by: shinenewstop at

09:34 AM

| No Comments

| Add Comment

Post contains 579 words, total size 4 kb.

Japan is considering a new round of stimulus scheme worth of 100

trillion yen(US$929.45 billion), which includes financial aid programs

for businesses under the shock of coronavirus pandemic.To get more news

about WikiFX, you can visit wikifx news official website.

The scheme will be funded by the second extra budget of the fiscal year starting this April.

According to Nikkei News, this will be the second massive stimulus

kicked off by the Japanese government after the record-breaking US$1.1

trillion spending plan launched last month, which focused on cash

assistance for households and loans to small businesses hit by the

pandemic.

We estimate Japanese governments economic stimulus will drive down the

price of the yen, which has also been reflected in the latest change of

forex market positions. As of May 19th, speculative net longs in JPY

decreased by 467 to 27,470 contracts, with speculative longs dropping

4,269 to 52,038 contracts and speculative shorts down by 3,802 to 24,568

contracts.

Overnight USD/CAD rate dropped 228 pips to 1.3773, a new low since

March 16th . This has been the largest intraday decline since March.

Bank of Canada‘s outgoing Governor Stephen Poloz maintains a dovish

forward guidance before leaving the post, saying that the central bank

is "doing the best to ensure a solid foundation for economic recoveryâ€.

Poloz is leaving the post in June, and he had previously warned that

massive monetary stimulus will be needed for Canada’s economy.

As the Bank of Canada remains open to introducing more unconventional

measures, the Canadian dollar may face even more unfavorable risks.

Canada will release on Friday the GDP for Q1, 2020, which is expected

to see the greatest decline since the data was first recorded and

published in 1961.

Posted by: shinenewstop at

09:18 AM

| No Comments

| Add Comment

Post contains 294 words, total size 2 kb.

UKs inflation rate in April fell to 0.8% to the lowest level for

nearly four years. Under this situation, the UK is likely to enter a

deflationary age, bringing the pressure that Bank of England(BoE) would

cut interest rates below zero.To get more news about WikiFX, you can visit wikifx news official website.

Andy Haldane, the BoE‘s chief economist, commented last week that

negative interest rates are a near-term possibility. While, the BoE’s

governor Andrew John Bailey who kept objecting to negative interest

rate, changes his attitude in a softly manner and starts to take into

consideration countries applying negative interest rate policy.

In addition to the trouble about deflation and negative interest rate,

the trade negotiations between the UK and EU came to a deadlock.

Britain‘s negotiator David Frost blamed the UE for a worse draft and

critically expressed the unfair draft for the UK in a 4-page open

letter, and urged the EU’s chief negotiator, Michel Barnier, to think it

twice.

It is estimated that before the next round of negotiation on July 1st,

the constant tension between two sides would hurt pound more. Even

though the second negotiation may take a dramatic turn, the pound

couldnt avoid dropping in the following week under the shadow of the

unsuccessful negotiation.

The Office of Budget Responsibility(OBR) estimated that the UKs budget

deficit would reach 298 billion pounds in 2020 to 2010. So most British

businessmen believe that the government will increase taxes in response

to the battered budget deficit suffered by COVID-19.

It is a remarkable fact that leaving aside the question whether the UK

and EU will end transition under the trade agreement, the UK will face

another political crisis next year that Scotland is determined to hold a

referendum on independence from the UK in 2021. The "Gray Rhino†event

really makes it easy for pound to drop and hard to rise.

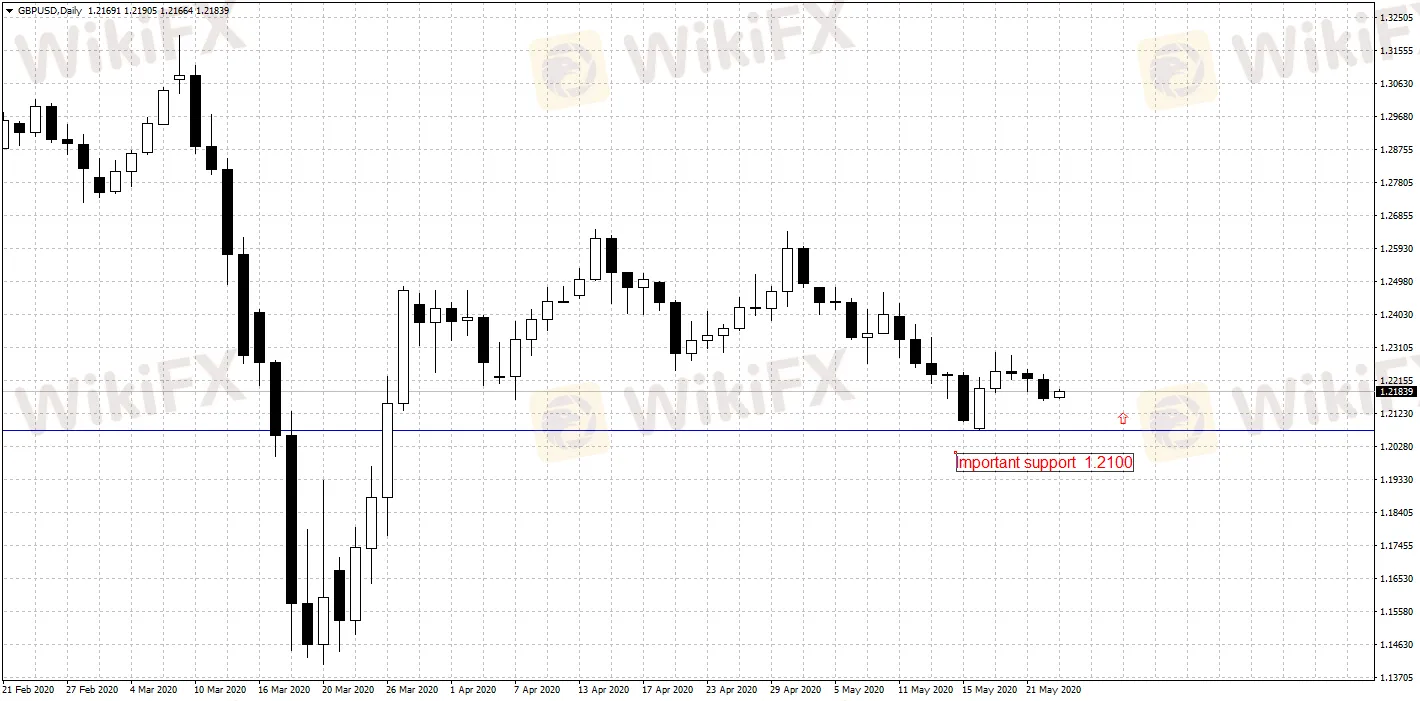

As the graph shows, GBP/USDs support levels are at 1.2069 and 1.1959.

If it breaks below both levels, GBP/USD is likely to challenge the key

support level of 1.1409 again.

If the negotiation between the UK and EU takes a dramatic turn,

GBP/USD also has an opportunity to return to the double top situation

with the resistance level of 1.2643.

Posted by: shinenewstop at

09:04 AM

| No Comments

| Add Comment

Post contains 386 words, total size 3 kb.

The Secret To Classic Wow Gold

Blizzard entertainment presents a fantastic server accessibility of the world of warcraft referred to as the world of warcraft classic. It is an remarkable regenerated form of the world of warcraft. A game is really a massively multiplayer on-line role-enjoying sport additionally, the utmost range of player participation is 60. This re-created version is extremely liked by individuals and enormousamounts of avid gamers are participated to experience the amazing popular features of the world of warcraft classic. You possibly can perform ineight races and also 9 classes in the world of warcraft classic. Blizzard entertainment adds incredible characteristics within this re-created model such as exciting quests, horrible monsters, resourceful character customization, incredible weaponry and many others. The previous subscribers of the wow expertise all the features of world of warcraft classic at cost free.To get more news about WoW Gold Classic Cheap, you can visit lootwowgold news official website.

If someone would like to become a part of wow classic then it is

super easy. Merely you can upload the app of blizzard entertainment and

complete the signing up by developing an account. It’s not easy for

players to accomplish the daring races as well as classes easily because

it is designed with superior features from the wow. The races and

classes of warcraft classic are made with all the daring as well as

exciting mission that is quite hard for participants to accomplish. So

the gamer ought to buy the currency of the recreation classic wow gold

to relish all features of the game play as well as participate in it

more thrilling. During the online game there is a chance of receiving

classic wow gold at free of cost for individuals because they are

rewarding along with a a little bit of currency when they conquered

opponents, completing quests or even goals and numerous others.

Alternatively you can purchase it right from sellers of gaming

currencies.

It has become player’s first personal preference due to its secure,

efficient and effective assistance. They will offer classic wow gold by

way of different distribution processes for that comfort of consumers

for example face to face, mail box or auction house. They’re also

delivering all game playing currencies at economical rates from all

additional merchants of the game playing industry. In addition Mmogah

provides top Mmogah coupons and other offers whereby avid gamers will

save the cash. Mmogah contains a greatreputation in the marketplace in

addition to their specialist avid gamers try out best endeavours to

accomplish the orders placed within a brief deadline day. On the whole

this is the appropriate spot to invest in classic wow gold firmly and

also securely. If you want to know more information regarding classic

wow gold, click this link as well ascheck out over the internet. Mmogah

members are 24/7 available for customer satisfaction services.

Posted by: shinenewstop at

08:27 AM

| No Comments

| Add Comment

Post contains 484 words, total size 3 kb.

A new WoW Classic exploit allowed a guild to generate over 100,000 gold by abusing the layering system, which let it skip a dungeon right to the final boss and farm it for money and loot. WoW Classic is almost a complete preservation of the World of Warcraft experience circa 2006, but the small changes that Blizzard made to help account for the expected long player queues have been the source of the few exploits players have found early in the game’s existence.To get more news about Buy WoW Gold Safe, you can visit lootwowgold news official website.

The first abuse of the WoW Classic layering system came in the race

to become the world’s first level 60 character in the game, a mad dash

that was eventually won by streamer Jokerd. Perhaps somewhat

controversially, however, Jokerd used the layering system to set himself

up nicely for the last few levels of the grind, getting friends to help

him instance into versions of the world map that were bereft of

players. As a solo player Frost Mage, Jokerd was then able to exploit

the fact that there were so many mobs by setting up massive group AoE

kills that made his leveling experience much more efficient. While that

exploit was much tamer and probably not so much against the rules of WoW

Classic as it was just a smart use of the resources available, however,

a new layering exploit is definitely against the spirit of the game.

Some illegal gold would make your account banned, but MMOWTS will never

do it, which is an honest shop that can supply WOW Classic Gold for a

long time to improve your ranking in the game. The purpose of the site

is that long-term customers can bring greater benefits, so it will never

deceive consumers. Of course, what you see is always more real than

what you hear, you are welcome to come at any time, and search for

everything that you want here.

Posted by: shinenewstop at

08:19 AM

| No Comments

| Add Comment

Post contains 339 words, total size 2 kb.

A woman from Iredell County bought a $20 lottery ticket at a Charlotte gas station.Cynthia Cutting of Statesville won the first $4 million prize playing the new scratch-off game "Millionaire Bucks,†officials with the N.C. Education Lottery announced Monday.Get more news about è²å¾‹å®¾å½©ç¥¨åŒ…网公å¸,you can vist loto98.com

Cutting took home a lump sum of nearly $1.7 million after taxes from the lottery headquarters in Raleigh on Thursday, according to a news release.

Officials said the prize-winning ticket was sold at Times Turnaround, a gas station on West W.T. Harris Boulevard.

At least one other winning ticket was previously sold at the same gas station — a $100,000 Powerball ticket in 2013, The Daily News in Jacksonville reported.Millionaire Bucks, which launched June 2, is a scratch-off game where matching numbers net prizes between $20 and $4 million, according to the Education Lottery’s website. Three of the $4 million prizes have not been claimed, as are five of the $100,000 prizes and 37 of the $10,000 prizes.

The overall odds of winning any of the prizes playing Millionaire Bucks is one in 3.06, the website states. Cutter had a one in 1.35 million chance of winning the top prize.A Mount Holly store sold a Cash 5 lottery ticket worth more than $1.1 million over the Memorial Day weekend.

Lee’s Quick Stop on North Main Street in Mount Holly sold the lucky ticket worth $1,127,585. The ticket beat odds of 1 in 962,598 to match all five numbers in the drawing. The winning numbers in the drawing were: 14-15-28-31-40.

Carolina Cash 5 tickets are $1 and drawings are held every night.The winner has not had a chance to come forward because offices were closed Monday for Memorial Day holiday.

Posted by: shinenewstop at

08:11 AM

| No Comments

| Add Comment

Post contains 293 words, total size 2 kb.

32 queries taking 0.0318 seconds, 111 records returned.

Powered by Minx 1.1.6c-pink.